Unlock the Secrets of M&A Mastery: A Step-by-Step Guide to Successful Deals

- Posted by admin

- On October 16, 2024

- 0 Comments

Mergers and Acquisitions (M&A) are pivotal strategies for businesses seeking growth, diversification, and competitive advantage. However, the path to successful M&A deals is fraught with complexities, requiring meticulous planning, comprehensive analysis, and strategic execution. This step-by-step guide provides a detailed, step-by-step roadmap to mastering M&A, ensuring that your transactions achieve their desired outcomes.

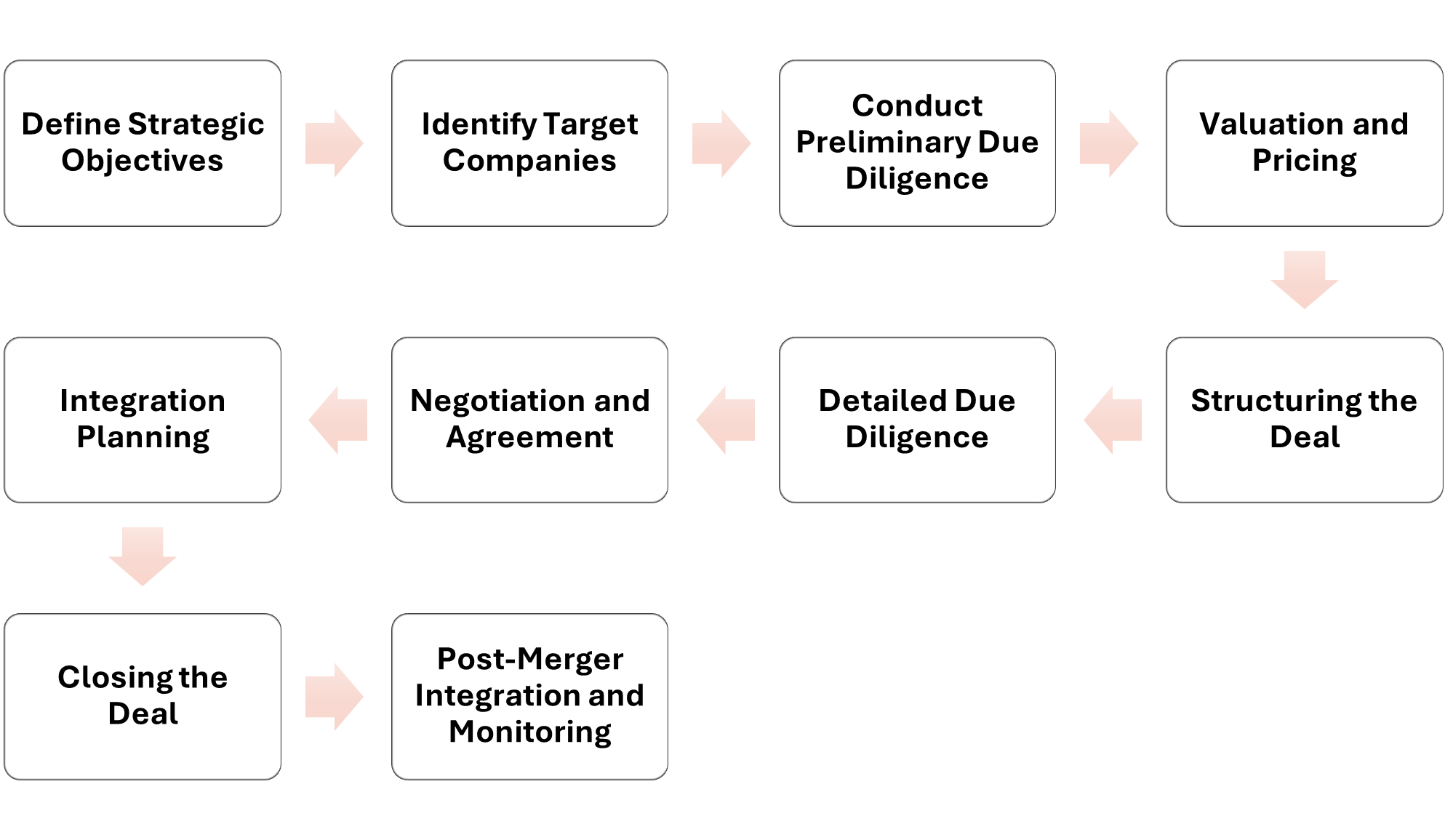

Illustration 1: Infographic: Steps to a successful M&A deal

Step 1: Define Strategic Objectives

The foundation of any successful M&A deal lies in clearly defined strategic objectives. Companies must articulate specific goals they aim to achieve through the transaction, such as expanding market share, acquiring new technologies, diversifying product lines, or entering new geographic markets.

Key Considerations:

Growth Opportunities:

Identify how the acquisition will drive growth, whether through expanding into new markets or enhancing product offerings.

Synergies:

Determine potential cost savings, revenue enhancements, and other synergies that the merger or acquisition can bring.

Risk Management:

Assess the risks involved in the transaction and ensure they align with your overall business strategy.

A well-defined objective sets the direction for the entire M&A process, helping to focus efforts and resources effectively.

Step 2: Identify Target Companies

Once strategic objectives are defined, the next step is to identify potential target companies that align with these goals. This involves extensive market research and due diligence to find businesses that offer the desired value propositions.

Key Considerations:

Industry Analysis:

Conduct a thorough analysis of the industry to understand the competitive landscape and identify potential targets.

Financial Health:

Evaluate the financial stability and performance of potential targets to ensure they meet your criteria.

Cultural Fit:

Consider the cultural compatibility between the acquiring and target companies to ensure smooth integration post-acquisition.

Identifying the right target is crucial, as it lays the groundwork for a successful transaction.

Step 3: Conduct Preliminary Due Diligence

Preliminary due diligence involves an initial assessment of the target company’s financials, operations, market position, and potential risks. This stage helps in determining whether to proceed with a formal offer.

Key Considerations:

Financial Statements:

Review historical and projected financial statements to gauge the company’s financial health.

Legal Issues:

Identify any ongoing or potential legal issues that could impact the transaction.

Operational Efficiency:

Assess operational processes and efficiencies to understand how they contribute to the company’s value.

Preliminary due diligence helps in filtering out unsuitable targets and focusing on viable options.

Step 4: Valuation and Pricing

Valuing the target company accurately is critical to making a successful acquisition. Various valuation methods, such as Discounted Cash Flow (DCF) analysis, comparable company analysis, and precedent transactions, can be used to determine a fair price.

Key Considerations:

Valuation Techniques:

Choose appropriate valuation methods based on the industry and target company characteristics.

Synergy Valuation:

Include potential synergies in the valuation to reflect the combined value post-acquisition.

Negotiation Strategy:

Develop a pricing strategy that provides room for negotiation while aiming to achieve a fair deal.

Accurate valuation ensures that you do not overpay for the target company, safeguarding your investment.

Step 5: Structuring the Deal

Deal structuring involves deciding on the terms of the acquisition, including the payment method (cash, stock, or a combination), the structure of the transaction (asset purchase or stock purchase), and any contingent payments (earnouts).

Key Considerations:

Payment Methods:

Evaluate the benefits and risks of different payment methods and choose the one that aligns with your financial strategy.

Tax Implications:

Consider the tax implications for both the acquiring and target companies to optimize the deal structure.

Regulatory Compliance:

Ensure the deal complies with relevant regulations and antitrust laws to avoid legal complications.

A well-structured deal balances the interests of both parties and enhances the likelihood of a successful transaction.

Step 6: Detailed Due Diligence

Detailed due diligence is a comprehensive investigation of the target company’s financials, operations, legal standing, and market position. This step aims to uncover any potential issues that could affect the value or feasibility of the deal.

Key Considerations:

Financial Due Diligence:

Financial due diligence goes beyond just auditing financial statements; it involves a deep dive into the financial health of the target company. This includes analyzing cash flow, profitability, revenue streams, debt levels, working capital, and any off-balance-sheet liabilities. Understanding the financial position and sustainability of earnings helps the buyer to assess the true financial health and potential risks associated with the acquisition.

Cash Flow Analysis:

Scrutinizing historical and projected cash flows to ensure the target company has a stable and predictable revenue stream.

Working Capital Requirements:

Understanding the working capital needs of the business to maintain smooth operations post-acquisition.

Debt and Liabilities Review:

Evaluating all existing debts and liabilities, including contingent liabilities, to avoid any future financial surprises.

Tax Due Diligence:

Tax due diligence is a critical aspect of M&A, as tax implications can significantly impact the value of the deal. This involves a thorough review of the target company’s tax compliance, liabilities, and potential exposures. Understanding the tax position helps in structuring the deal to optimize tax outcomes and mitigate any future tax risks.

Tax Compliance Review:

Ensuring that the target company has complied with all relevant tax laws and regulations, including income, sales, and payroll taxes.

Tax Liabilities and Contingencies:

Identifying any existing or potential tax liabilities that could affect the financial standing of the target company post-acquisition.

Transfer Pricing Risks:

Assessing transfer pricing arrangements to ensure they are in line with international tax laws, particularly for cross-border transactions.

Legal and Compliance:

Review all legal contracts, compliance records, and intellectual property rights to ensure there are no legal hurdles.

Operational Review: Examine supply chain, production processes, and IT systems to understand their efficiency and integration potential.

Detailed due diligence, encompassing both financial and tax aspects, mitigates risks and provides a clear picture of the target company’s true value.

Step 7: Negotiation and Agreement

Negotiation is a critical phase where the terms of the deal are finalized. This involves negotiating the purchase price, payment terms, representations and warranties, indemnities, and closing conditions.

Key Considerations:

Negotiation Tactics:

Employ effective negotiation tactics to achieve favorable terms while maintaining a collaborative relationship with the target company.

Contract Terms:

Ensure all terms and conditions are clearly defined in the agreement to prevent disputes post-acquisition.

Stakeholder Approval:

Obtain approval from key stakeholders, including the board of directors and shareholders, to ensure alignment and support for the deal.

Successful negotiation sets the stage for a smooth closing and integration process.

Step 8: Integration Planning

Post-merger integration is often the most challenging part of an M&A deal. Effective integration planning ensures that the combined entities can operate seamlessly and realize the expected synergies.

Key Considerations:

Integration Team:

Form a dedicated integration team with representatives from both companies to manage the integration process.

Cultural Integration:

Develop a plan to integrate corporate cultures and manage change to ensure employee buy-in and minimize disruptions.

Operational Integration:

Align systems, processes, and workflows to achieve operational efficiencies and synergies.

A well-executed integration plan is critical to realizing the full value of the M&A deal.

Step 9: Closing the Deal

Closing the deal involves executing the final agreement and transferring ownership. This step requires meticulous attention to detail to ensure all contractual obligations are met.

Key Considerations:

Regulatory Filings:

Complete all necessary regulatory filings and notifications to comply with legal requirements.

Closing Checklist:

Follow a detailed closing checklist to ensure all steps are completed and nothing is overlooked.

Communications Plan:

Communicate the closure of the deal to all stakeholders, including employees, customers, and investors, to ensure transparency and support.

A smooth closing process minimizes disruptions and sets the stage for successful integration.

Step 10: Post-Merger Integration and Monitoring

The final step is post-merger integration and ongoing monitoring to ensure the deal delivers the expected benefits. This involves tracking performance, managing integration challenges, and making necessary adjustments.

Key Considerations:

Performance Metrics:

Establish key performance indicators (KPIs) to monitor integration progress and measure success.

Feedback Loop:

Create a feedback mechanism to address any issues promptly and make adjustments as needed.

Continuous Improvement:

Continuously refine integration processes to achieve long-term success and maximize value.

Ongoing monitoring and adjustments ensure that the M&A deal continues to deliver value over time.

Conclusion

Mastering M&A deals requires a strategic approach, meticulous planning, and effective execution. By following this step-by-step guide, companies can navigate the complexities of M&A transactions and achieve successful outcomes. Each stage, from defining strategic objectives to post-merger integration, plays a crucial role in ensuring the deal delivers the desired value and positions the company for future growth.

0 Comments