U.S. Hotel Performance Q4 2024

- Posted by admin

- On March 21, 2025

- 0 Comments

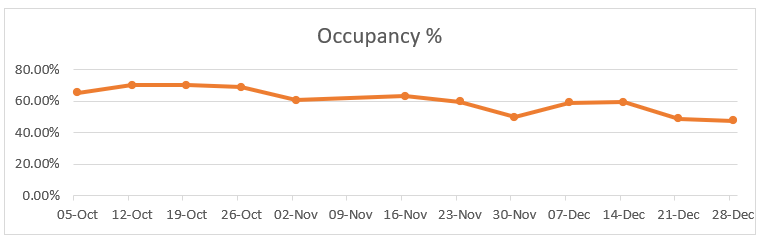

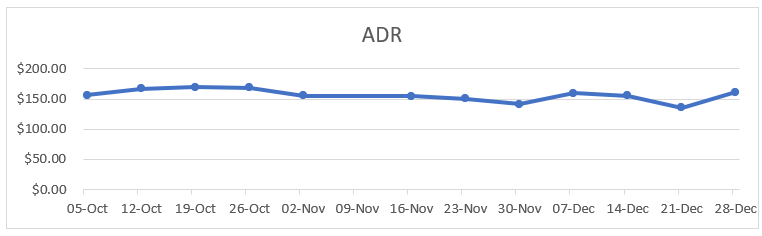

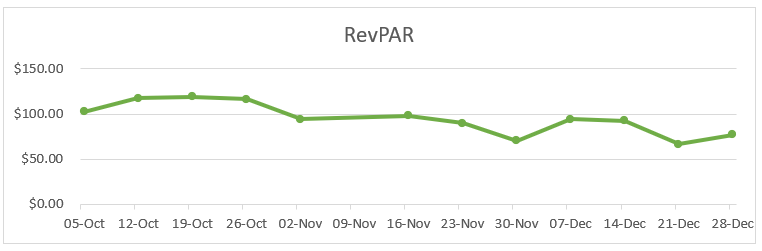

Q4 2024 was quite a stable quarter for the U.S. hotel performance. The performance remained quite robust with the exception of a few weeks during Thanksgiving and Hurricane Milton and unexpectedly during the week ending 28th December 2024 during the Holidays.

Occupancy was reported at 65.60% at the start of Q4 2024, which decreased to 47.70% at the end of Q4 2024. ADR was $156.25 at the start of Q4 2024, which increased to $160.96 at the end of Q4 2024. RevPAR was $102.44 at the start of Q4 2024, which decreased to $76.83 at the end of Q4 2024.

(Source: STR)

Analytical Summary

Major Q4 2024 transactions (By Sale Price)

| 1. Hotel Name: Sheraton Grand Chicago Riverwalk

Location: Chicago, IL No. of rooms: 1,218 Sale Price: $300,000,000 Price per unit: $246,305 per unit Seller: MetLife Inc Buyer: Marriott International |

|

| 2. Hotel Name: Residence Inn at Anaheim Resort/Convention

Location: Anaheim, CA No. of rooms: 294 Sale Price: $179,300,000 Price per unit: $609,864 per unit Seller: T2 Hospitality Buyer: DCC Hospitality REIT, Inc. |

|

| 3. Hotel Name: Springhill Suites at Anaheim Resort

Location: Anaheim, CA No. of rooms: 174 Sale Price: $124,000,000 Price per unit: $712,644 per unit Seller: T2 Hospitality Buyer: DCC Hospitality REIT, Inc. |

|

Source: CoStar

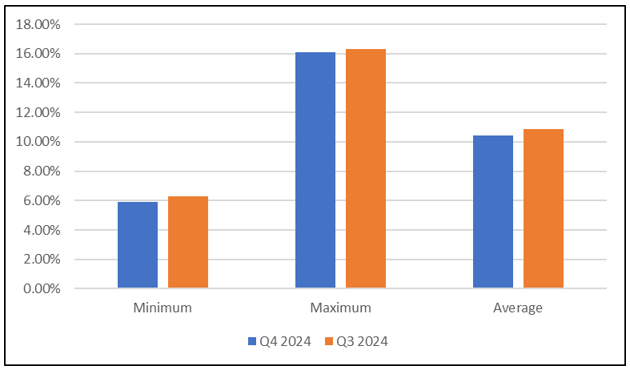

Q4 2024 Cap Rates

Average cap rates for U.S. hotels decreased by 42 basis points in Q4 2024 as compared to Q3 2024. The following table illustrates minimum, maximum, and average cap rates for U.S. hotels in Q4 2024 & Q3 2024.

(Source: RealtyRates.com)

| Cap Rate | Q4 2024 | Q3 2024 | Difference (bps) |

| Minimum | 5.91% | 6.31% | 13 |

| Maximum | 16.11% | 16.34% | 4 |

| Average | 10.45% | 10.87% | 12 |

Source: RealtyRates.com

Outlook

The U.S. hospitality property sector in 2025 is poised for a cautiously optimistic recovery, building on stabilizing economic conditions and renewed consumer confidence. Hotel occupancy rates are expected to climb steadily, with urban markets leading the charge as business travel rebounds to pre-pandemic levels. Leisure travel will remain a key driver, though growth may taper slightly as pent-up demand normalizes. Revenue per available room (RevPAR) is projected to rise modestly, supported by higher average daily rates despite competitive pricing pressures. Labor shortages, while easing, will continue to challenge operators, pushing investment in automation and staff retention strategies. Luxury and boutique properties are likely to outperform, capitalizing on travelers’ willingness to splurge on unique experiences. Mid-tier and budget segments may face tighter margins due to cost-conscious consumers and rising operational expenses. Sustainability initiatives will gain traction, with eco-friendly upgrades becoming a competitive edge for attracting younger demographics. Coastal and resort destinations should see robust demand, while secondary markets could lag without significant infrastructure investment. Overall, the sector’s outlook hinges on macroeconomic stability, with adaptability remaining critical for success in an evolving landscape.

0 Comments