Sustainability Reporting Standards

- Posted by kalyani

- On January 23, 2024

- 0 Comments

Globally, companies are striving to increase transparency in their ESG (Environment, Social, Governance) & sustainability disclosures and provide insight into their compliance with the Paris Agreement.

Investors as well are gravitating towards sustainability & ESG focused companies and seek actionable information about the sustainability measures taken by them. Thus, sustainability disclosures are now essential to company’s operational and financial performance. The rising importance of sustainability is spurring the shift towards better reporting practices and standardization.

Growing Prevalence of Sustainability Standards

As the threat of climate change looms, it becomes even more critical for companies, investors, and regulators to spearhead ESG activism. This gives more weightage to companies which are ESG compliant and report comprehensive disclosures on sustainability.

As per the analysis of Center for Audit Quality (CAQ) on the annual ESG reports published by S&P 500 companies, third-party assurance or verification was received by over 60% of S&P 500 companies that issued an ESG report disclosing the data in their reports.

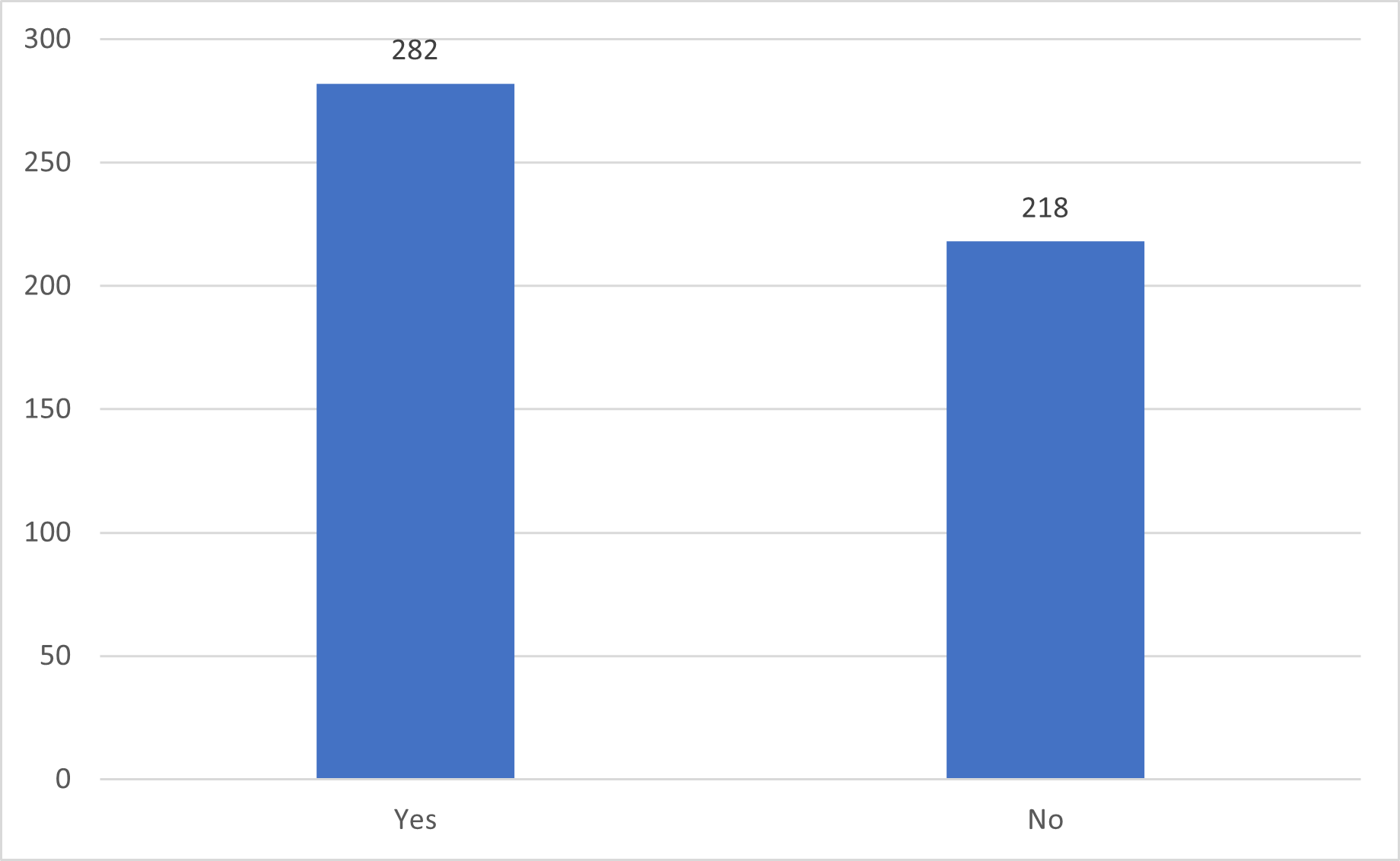

Illustration 1: Chart – Acquired Assurance or Verification

In light of the growing demand for assurance from regulators and others, this number is likely to continue to grow. The analysis also found that the percentage of accounting firms engaged in assurance increased to 15%.

Evolution of Global Sustainability Reporting Standards

To facilitate companies in generating reliable, transparent performance, there exist various standards including the Sustainability Accounting Standards Board (SASB), Global Reporting Initiative (GRI) Standards and Task Force on Climate-Related Financial Disclosures (TCFD).

Founded in 2011 and managed by Value Reporting Foundation (VRF), SASB has been one of the most used frameworks. SASB standards are sector-specific and created for investors who require sustainability related information that impacts a company’s valuation.

In March 2022, the International Sustainability Standards Board (ISSB) released Exposure Draft IFRS S2 Climate-related Disclosures, incorporating and expanding upon the recommendations of the TCFD and integrating industry-specific disclosure requirements drawn from SASB Standards.

In August 2022, the ISSB took over the stewardship of the SASB Standards from the VRF. This transition occurred as the VRF consolidated into the IFRS Foundation. The ISSB is dedicated to preserving and improving the SASB Standards, urging ongoing utilization.

In June 2023, the ISSB formally issued IFRS S2 Climate-related Disclosures.

The ISSB’s approach involves consolidating and building upon existing frameworks, standards, and guidance rather than creating entirely new ones. Collaborative efforts by organizations like the VRF, CDSB, TCFD, and the World Economic Forum are committed to contributing their content to support the ISSB and strive for coherence between financial reporting and sustainability disclosures. The anticipation is that the ISSB’s standards will gain global adoption, driven by a combination of regulatory requirements and market support.

IFRS Sustainability Disclosure Standards

The introduction of the ISSB’s inaugural standards, IFRS S1 and IFRS S2, signals the commencement of a new era for sustainability-related disclosures in global capital markets. These standards play a pivotal role in enhancing trust and confidence in company disclosures regarding sustainability, providing crucial information for informed investment decisions.

In December 2023, the ISSB released amendments aimed at bolstering the global relevance of the SASB Standards.

Adopting both the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures is advantageous for companies, especially those already acquainted with the SASB Standards. Familiarity with SASB Standards positions these companies favorably when transitioning to the IFRS Sustainability Disclosure Standards.

IFRS S1

Within IFRS S1, companies must consult and take into account the SASB Standards when identifying pertinent sustainability-related risks and opportunities for reporting, as well as when choosing the appropriate disclosures related to those risks and opportunities.

IFRS S2

IFRS S2 will be applicable for annual reporting periods commencing on or after January 1, 2024, and entities have the option to apply it earlier, subject to the condition that IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information is simultaneously implemented.

IFRS S2 explicitly requires organizations to disclose details regarding climate-related risks and opportunities that are likely to affect the entity’s cash flows, access to finance, or cost of capital. This encompasses impacts over the short, medium, and long term, collectively termed as ‘climate-related risks and opportunities that could reasonably be anticipated to influence the entity’s prospects.’

In detail, IFRS S2 necessitates disclosure of information enabling users of general-purpose financial reports to comprehend:

- The governance processes, controls, and procedures employed by the entity to monitor, manage, and oversee climate-related risks and opportunities.

- The entity’s strategy for handling climate-related risks and opportunities.

- The processes used by the entity to identify, assess, prioritize, and monitor climate-related risks and opportunities, including integration into and influence on the entity’s overall risk management process.

- The entity’s performance concerning its climate-related risks and opportunities, encompassing progress toward any set climate-related targets, as well as compliance with targets mandated by law or regulation.

Impact on Report Preparers and Users

The impact on report preparers and users emphasizes a seamless transition from current standards, such as SASB, to the upcoming IFRS Sustainability Disclosure Standards. The short-term outlook encourages continuity, with a call for ongoing efforts in disclosure to facilitate a smoother transition. In the medium term, stakeholder input remains crucial in shaping the development of IFRS Sustainability Disclosure Standards, leveraging prototypes that incorporate feedback and best practices from existing frameworks. Looking ahead in the long term, the goal is to establish a streamlined reporting landscape that encompasses both financial and sustainability aspects, providing a comprehensive view of a company’s performance and prospects to the financial markets.

Conclusion

In conclusion, the prevalence of sustainability standards is growing, with an emphasis on ESG compliance and comprehensive sustainability reporting. Third-party assurance or verification is becoming increasingly common, as evidenced by over 60% of S&P 500 companies receiving such validation for their ESG reports. This trend is likely to continue, driven by regulatory demands and growing expectations for reliable sustainability information.

As the journey towards sustainable and transparent business practices continues, the commitment to keeping the market informed, involved, and well-prepared for these transformative changes remains a shared responsibility among companies, investors, and regulatory bodies.

0 Comments