Unlocking the Value of Intangible Assets

- Posted by kalyani

- On March 13, 2024

- 0 Comments

In the realm of modern business and evolving financial reporting, the importance of intangible assets like trademarks, patents, technology, and customer relationships has significantly increased. Understanding their value becomes paramount as these assets play a crucial role in generating revenue and sustaining business operations, especially during a merger or acquisition. In the following sections, we explore the accounting of intangible assets during a business combination, and the methodologies used to fair value them, offering practical insights for navigating this complex landscape.

What are Intangible Assets?

Intangible Assets are “non-physical assets such as franchises, trademarks, patents, copyrights, goodwill, equities, mineral rights, securities and contracts (as distinguished from physical assets) that grant rights and privileges and have value for the owner.”

Intangible Assets can be classified into categories based on the source of their existence:

- Purchased

- Acquired; or

- Internally generated

A further classification can determine the lifespan or useful life of these assets:

(1) Purchased and (2) Acquired intangible assets can generally be classified as either a definite (finite) or indefinite useful life depending on the asset, whereas (3) Internally generated intangible assets can only have a finite lifespan.

The treatment for the finite and indefinite life of these assets differs as follows:

Intangibles with finite lives are subject to amortization over the useful life of their value creation, whereas the same does not apply to those with indefinite lives. Moreover, while all intangibles are required to be tested for impairment, intangibles with indefinite lives are required to be impairment-tested at least once a year.

The State and Nature of Intangible Assets Today

Given the trend of increasing importance of intangible assets, there is an unprecedented environment for the need for adequate classification, understanding, and valuation of these assets. With divestitures and consolidation in the corporate world, increasing deal flow, and an observably larger appetite for M&A, the accounting of intangibles acquired in a business combination has taken the spotlight.

It is essential to understand that while rules and regulations govern the treatment of intangible assets, they also require the careful consideration and discretion of the management and valuation professionals scrutinizing the legitimacy of their recognition.

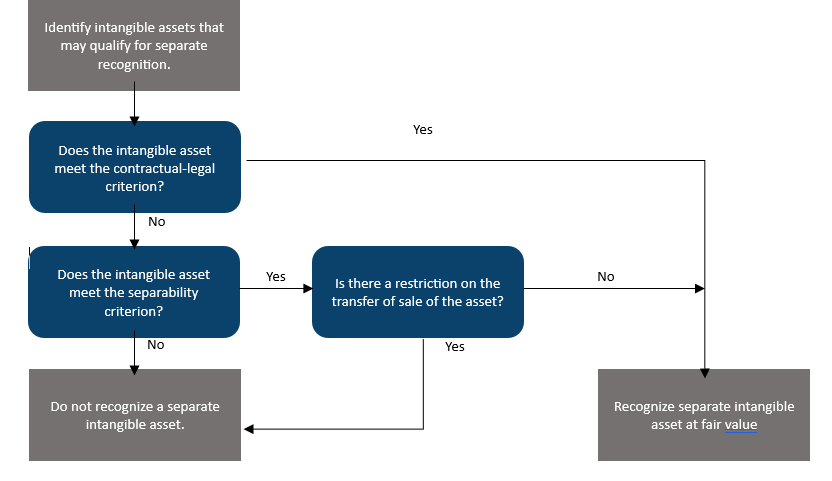

As per ASC 805: Business Combinations, for an intangible asset to be identified separately from goodwill, either of the following criteria must be satisfied in accordance with the financial reporting standards:

- is separable, i.e., is capable of being separated or divided from the entity and sold, transferred, licensed, rented, or exchanged, either individually or together with a related contract, identifiable asset, or liability, regardless of whether the entity intends to do so; or

- arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights and obligations.

Identifiability Criteria Flowchart[1]

Commonly observed Intangible Assets

| Intangible asset | Description |

| Existing customer relationships |

|

| Trademarks |

|

| Developed technology/Software |

|

| Non-compete agreements |

|

| Assembled workforce |

|

| Favorable / Unfavorable contracts (Leases) |

|

Valuation Methods:

The valuation of intangible assets borrows some basic principles from the methods and techniques used to value tangible assets and economic entities as a whole. This entails the income approach, market approach, and replacement cost approach. Some commonly used valuation methods used to value intangible assets are: [2]

- Multiperiod Excess Earnings Method: This method isolates the projected cashflows associated with the intangible asset being valued and discounts the projected stream of flows using a suitable discount rate to the present value. This method is beneficial when the presence of an asset is directly tied to certain cashflows and can be quantified. Customer relationships, client lists, and computer software can often be valued using this approach. Moreover, this approach is helpful for valuing developed technology assets.

- Relief from Royalty Method: Owning an asset eliminates the need to rent the permission to use somebody else’s asset and also minimizes the costs associated with facilitating the permission. It uses the hypothetical royalty payments associated with licensing or borrowing the asset to estimate the cost savings and, hence, the value of the intangible. This method is often used to value licensed software, domain names, trademarks, and R&D that is associated with a revenue stream that would likely incur royalty costs. It is imperative to estimate the useful life of the asset and collect market data on suitable and comparable royalty rates.

- With and Without Method (“WWM”): Adopting a fairly simple ideology, the WWM makes use of calculating the difference between two discounted cashflow models- one that factors in the cashflows with the asset in place and another that considers the potential cashflows without the asset. The difference in value is often used to value intangibles such as non-solicitation and non-compete agreements.

- Replacement Cost Method Less Obsolescence: This model aims at concluding the value of constructing the intangible asset with current market prices, production standards, labor skill set, and available resources in mind that would provide the utility equivalent of the intangible asset being valued. This is considered as the cost of replacing the asset with current economic headwinds and tailwinds in mind. This method is useful for valuing intangibles such as proprietary software, internal systems, and assembled workforce.

- Real Option Pricing Method: When considering the contingent success of an asset in generating future cash flow, an option pricing method can model the price of the intangible asset similar to an option priced using the Black-Scholes Option Pricing Model. Patents and right of use of natural resources can often be valued using this method since it gives the patent holder the right but not the obligation to prevent competitors from utilizing the cash-flow generating intangible asset for a fixed period of time (time to expiration) with certain uncertainty (volatility) and an expected cost of delay (dividend yield).

In addition to above discussed commonly used valuation methods, alternatives like the distributor , greenfield , and cost savings methods offer nuanced approaches for appraising intangible assets. These techniques provide varied perspectives, assessing factors such as market position, developmental costs, and operational efficiencies to determine assets’ value.

Summary:

In summary, intangible assets come in various forms, and their accurate assessment entails domain-specific expertise to not only appropriately value them but also categorize and ascertain their relevance for both financial due diligence and valuation.

0 Comments