U.S. Hotel Performance Q1 2025

- Posted by admin

- On July 6, 2025

- 0 Comments

After a challenging early January due to the holiday season calendar shift, the U.S hotel performance improved due to several factors in Q1 2025. The presidential inauguration, MLK weekend, and resumed convention/business travel boosted demand in late January. The national hotel performance remained robust thereafter.

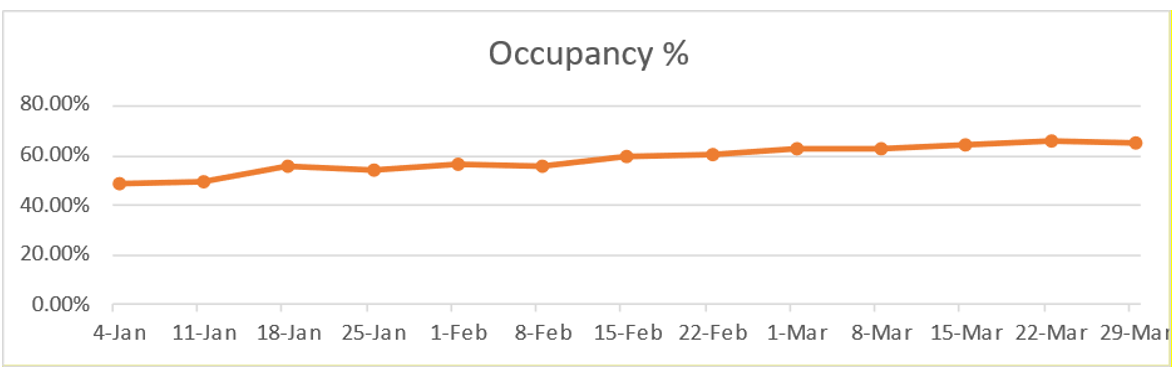

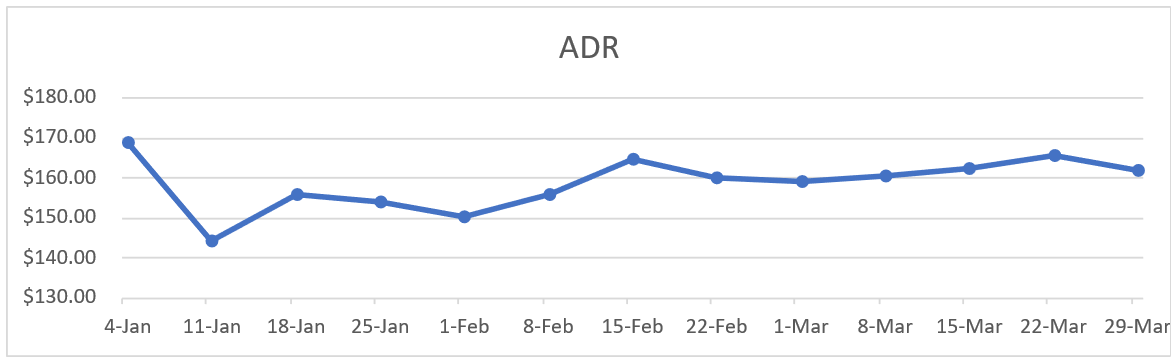

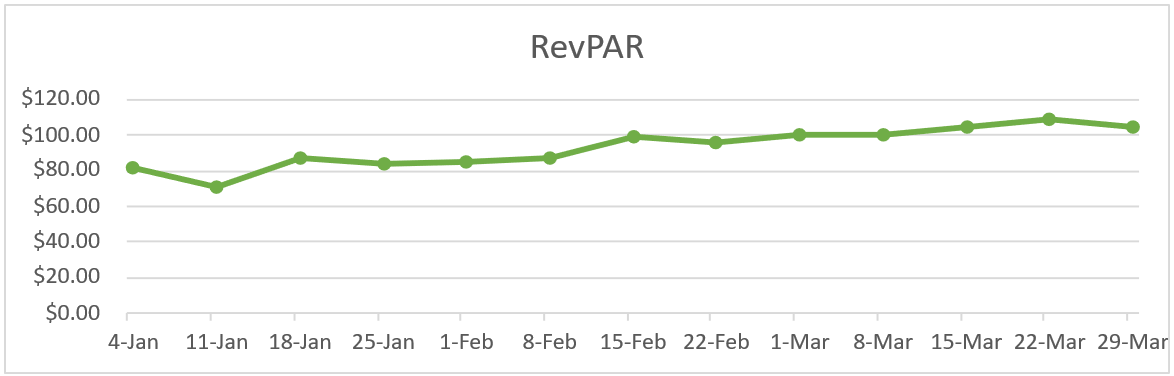

Occupancy was reported at 48.30% at the start of Q1 2025, increasing to 65.10% by the end of Q1 2025. ADR was $168.90 at the beginning of Q1 2025, decreasing to $161.65 by the end of Q1 2025. RevPAR was $81.53 at the start of Q1 2025, increasing to $105.19 by the end of Q1 2025.

(Source: STR)

Analytical Summary

Major Q1 2025 transactions (By Sale Price)

| 1. Hotel Name: The Ritz-Carlton

Location: New Orleans, LA No. of rooms: 1,218 Sale Price: $141,700,000 Price per unit: $116,338 per unit Seller: Quorum Hotels & Resorts Buyer: Gencom |

|

| 2. Hotel Name: Courtyard Boston Downtown

Location: Boston, MA No. of rooms: 315 Sale Price: $123,000,000 Price per unit: 390,476 per unit Seller: Ashford Hospitality Trust Buyer: Seaview Capital |

|

| 3. Hotel Name: Hilton Atlanta Airport

Location: Atlanta, GA No. of rooms: 510 Sale Price: $111,300,000 Price per unit: $218,235 per unit Seller: Wheelock Street Capital Buyer: Highline Hospitality Partners |

|

Source: CoStar

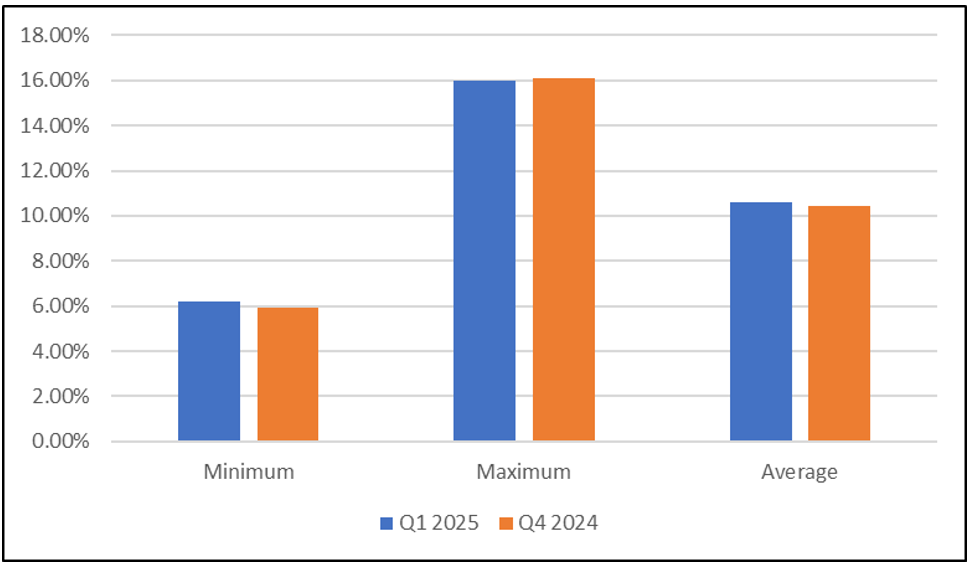

Q1 2025 Cap Rates

Average cap rates for U.S. hotels increased by 16 basis points in Q1 2025 as compared to Q4 2024. The following table illustrates the minimum, maximum, and average cap rates for U.S. hotels in Q1 2025 and Q4 2024.

(Source: RealtyRates.com)

| Cap Rate | Q1 2025 | Q4 2024 | Difference (bps) |

| Minimum | 6.18% | 5.91% | 27 |

| Maximum | 16.01% | 16.11% | -10 |

| Average | 10.61% | 10.45% | 16 |

Source: RealtyRates.com

Outlook

The U.S. hotel sector in Q2 2025 is poised for stable, modest growth, with RevPAR and occupancy inching upward, driven by higher-end hotels and urban markets. While group and business travel provide tailwinds, challenges such as macroeconomic uncertainty, price-sensitive leisure travelers, and competitive pressures from short-term rentals could temper the gains. Stakeholders should focus on operational efficiencies and monitor policy changes to navigate this cautiously optimistic landscape. Geopolitical tensions and potential trade disruptions could further impact international travel and consumer confidence.

0 Comments